The pundits would have you believe that Italy and Spain are about to be swept into the European Debt crisis, and that this is somehow going to bring down their economies, and possibly spark enough contagion to bring down others. That's nonsense.

First, we have a commodity bubble, then we have profit warnings, then the stock market stagnates, then investors loose confidence, then the market crashes, then the economy slumps. It happened in 2008 and they blamed it on mortgages, even though mortgage debt losses and all associated debts didn't match the bursting of the commodity bubble. This time there blaming it on the European debt bubble. Bubbles always burst. The question is why.

In 2011 worldwide growth is back with a spring in its step, demand has once again outpaced supply thanks to a constrained global market for oil, and thus pretty much everything else, because it all needs transporting. The cost of running a container ship for a day at sea has doubled this year alone, from $15,000 to $30,000. That's why profits are down again this summer.

Take Italy for instance, it's government is borrowing the equivalent of only 4% of the countries GDP each year, and that doesn't take into account the balancing effect money it's creditors lend out of Italy. Interest rates on 10 year government debt have moved to just over 5%. That only applies to money being borrowed today, not to bonds that have been sold in the past. Effectively therefore, the cost of the Italian government's spending deficit comes in at 0.2% of GDP. Given that is significantly lower than the amount actually being borrowed, the deficit is financially profitable. Simple arithmetic reveals all fears of a 'debt crisis' in this case to be a bad joke at best.

More to the point, investors fear falling tax receipts, which could make the deficit balloon. This scenario is highly realistic, given the bleak outlook for stock prices whilst commodities remain high. Also, although they are high, the boom seems to be stabilizing, and hungry bulls will have to look elsewhere for food. Therefore it's only logical that yields on sovereign debt will be bid up slightly whilst commodities remain high, for both reasons.

The news pretends to mindread investors by using headlines based on this "x/y rises/falls amid fears of..." template. Just because two things are 'amid' doesn't mean they are causing each other, they are just symptoms of the wider crisis in the system. They got it wrong in 2008, and they are getting it wrong in 2011, just as I predicted, how I predicted, when I predicted. But they run the place. Oh well. Perhaps the real problem is that there is no education system for middle aged prime ministers and presidents. 'Political school'; anyone? Didn't think so...

The truth, the whole truth, and nothing but the truth, at least as far as I can work out.

Monday 11 July 2011

Friday 17 June 2011

That age old debate between communism and capitalism is an illusion of socio-linguistics.

This one isn't for the faint of heart.

The (perceived) conflict between capitalism and communism is littered with intellectual misappropriation. These are just labels for social relations structures, that when analyzed, are to all intents and purposes identical. When we perceive distinctiveness in one or another we are simply noting conformity with one of our mentally preconceived definition matrices. These matrices incorporate various characteristics, and the way in which we see subconsciously selected these characteristics is influenced by the social relations system in which we live. In other words, the notion that there is an intrinsic difference between the two is simply an artefact of our recognition of differences in the socio-political stratification of nations.

The debate essentially concerns the distribution of power and ownership. Since the distribution of power and ownership is often illusory in nature, it is immediately difficult to form any clear classification criteria for political systems, capitalism and communism being two examples. It is commonly held belief that ‘communism’ is some form of social relations structure that sees power and wealth in the hands of the state, on behalf of the people. ‘In capitalism’, the argument may be that hierarchy is determined according to private property, and that the state power of the otherwise ‘communist’ system is subjugated to the capitalist individual. The idea that there is some significant difference between individuals operating as the state and individuals operating as a corporation is an artefact of linguistic expediency. Our labelling of social relations system according to ownership hierarchies is done only with the intention of advancing whichever form of ownership we want to advance, otherwise, there would be no need for distinctions.

Pre-civilization living was hierarchical, but was not capitalist. Individuals contributed as component parts of whichever nomadic tribe they belonged to, and the lack of economic competition is the defining difference between pre-civilization social relations and civilization social relations. The development of hierarchical civilizations generated political conflicts, and in turn these political conflicts came to be defined by differences in opinion about how the hierarchies should be styled. In reality, all ‘politicians’ advocated hierarchy by definition, since they themselves sought to gain power, which axiomatically implies hierarchy at least in the sense of a power relativism. The descriptions of the politicians proposed tweaks to hierarchy were motivated in much the same way as modern day product marketing is. Descriptions such as ‘capitalism’ and ‘communism’ can be seen to be, by their very nature, non academic, since they did not arise of curiousness, rather out of greed and politics, money and power.

So the difference between these two systems essentially rests on the idea that power changes form according to who holds it. The ‘state’ and the ‘corporation’ are anthropogenic social constructions, and as such communism and capitalism are anthropogenic social constructs, since they derive their respective definitions from these institutions; except, the state and the corporation are not institutions in their own right, they are merely examples of many possible extensions of the economic (distributive) ‘institution’. An institution must have a responsibility unique to itself, and that is why the state and the corporation cannot be regard as whole institutions in the classic sense, because they share the purpose of distribution, albeit seeking to do so in differing ways. A corporation could well be viewed as a microcosm of a state, the only relevant difference being the cosmetic one between geographical national boundaries and social business agreements. Thus, capitalism is a form of ‘social-ism’ whereas communism is a form of ‘geographical-ism’. When we see that ‘social-ism’ is a distributive system on a geographical scale that is defined similarly to what is regarded as ‘communism’ the definitions are blurred to the point of insignificance.

The (perceived) conflict between capitalism and communism is littered with intellectual misappropriation. These are just labels for social relations structures, that when analyzed, are to all intents and purposes identical. When we perceive distinctiveness in one or another we are simply noting conformity with one of our mentally preconceived definition matrices. These matrices incorporate various characteristics, and the way in which we see subconsciously selected these characteristics is influenced by the social relations system in which we live. In other words, the notion that there is an intrinsic difference between the two is simply an artefact of our recognition of differences in the socio-political stratification of nations.

The debate essentially concerns the distribution of power and ownership. Since the distribution of power and ownership is often illusory in nature, it is immediately difficult to form any clear classification criteria for political systems, capitalism and communism being two examples. It is commonly held belief that ‘communism’ is some form of social relations structure that sees power and wealth in the hands of the state, on behalf of the people. ‘In capitalism’, the argument may be that hierarchy is determined according to private property, and that the state power of the otherwise ‘communist’ system is subjugated to the capitalist individual. The idea that there is some significant difference between individuals operating as the state and individuals operating as a corporation is an artefact of linguistic expediency. Our labelling of social relations system according to ownership hierarchies is done only with the intention of advancing whichever form of ownership we want to advance, otherwise, there would be no need for distinctions.

Pre-civilization living was hierarchical, but was not capitalist. Individuals contributed as component parts of whichever nomadic tribe they belonged to, and the lack of economic competition is the defining difference between pre-civilization social relations and civilization social relations. The development of hierarchical civilizations generated political conflicts, and in turn these political conflicts came to be defined by differences in opinion about how the hierarchies should be styled. In reality, all ‘politicians’ advocated hierarchy by definition, since they themselves sought to gain power, which axiomatically implies hierarchy at least in the sense of a power relativism. The descriptions of the politicians proposed tweaks to hierarchy were motivated in much the same way as modern day product marketing is. Descriptions such as ‘capitalism’ and ‘communism’ can be seen to be, by their very nature, non academic, since they did not arise of curiousness, rather out of greed and politics, money and power.

So the difference between these two systems essentially rests on the idea that power changes form according to who holds it. The ‘state’ and the ‘corporation’ are anthropogenic social constructions, and as such communism and capitalism are anthropogenic social constructs, since they derive their respective definitions from these institutions; except, the state and the corporation are not institutions in their own right, they are merely examples of many possible extensions of the economic (distributive) ‘institution’. An institution must have a responsibility unique to itself, and that is why the state and the corporation cannot be regard as whole institutions in the classic sense, because they share the purpose of distribution, albeit seeking to do so in differing ways. A corporation could well be viewed as a microcosm of a state, the only relevant difference being the cosmetic one between geographical national boundaries and social business agreements. Thus, capitalism is a form of ‘social-ism’ whereas communism is a form of ‘geographical-ism’. When we see that ‘social-ism’ is a distributive system on a geographical scale that is defined similarly to what is regarded as ‘communism’ the definitions are blurred to the point of insignificance.

Thursday 16 June 2011

Here we go again...

The sheer irony of the current economic outlook is simply breathtaking. In 2008, the mighty Lehman brothers, leveraged to the hilt, were knocked out of businesses by a small spike in oil prices that contributed to the bursting the hose price inflation bubble. You might not be surprised to learn that banks such as Lehman helped arrange complicated balance transactions designed to conceal the level of Greece's debt.

When you think about it, the correlation between the high point of this oil price cycle and Greece's current troubles makes perfect sense. As the cost of running public services is driven up slightly by the price of oil, the budget (arranged when the price per barrell was substantially lower) just won't make ends meet. As you may have noticed, the oil price bubble seems to have stagnated, falling from $125 p/b to $115 p/b over the last month. Those investors who were riding the gravy train upwards now need a new source of income to compensate for the declining value of their oil asset. What better than to pick on the weakest kid and sell greek debt to drive up yields (and then arrange to re purchase them at higher interest with convenient conditions attatched)...

The country is now on the brink of bankruptcy- with yields (effectively interst rates) on 2 year debt up to 28% p/a. There is simply no way the Greek government can afford to borrow any more money. The ponzi scheme is over. Greece is now living off pay day loans, and the loan shark is bringing out the baseball bat. On a back of the paper calculation, Greece would have to start growing 15% a year to possibly sustain its current debt burden without immediate assistance. They're currently in a 6% a year recession.

In the UK, figures just released show retail sales slumped 1.4% in May. Did I predict that one of the symptoms of the coming crash would be a decline in retail sale volumes? Essentially yes; I argued that one of the factors in the 2008 crash was a decline in retail shares- obviously linked to sales- in turn linked to the "credit crunch"- and most importantly, oil. None of these signs bode well for anyone. The market is more vulnerable now than it was in 2008, like a rabbit in a tiger cage, all it can hope for is that the tiger start fighting each other over it, and it can escape in the meantime. The analogy here is that the different economic jitters we face right now could to some extent offset each other. If growth stumbles, inflation will too, and so might interstest rates on European debt. However, it's almost inconveicably unlikely that the right "balance" between the different crisis will come about by chance. Investors are acting with a predator mentality with no regard for sustainability in their decision making. "Every man for himself" pretty much sums up the current situation.

A greek default could be significant enough to wipe out enough of bank balance sheets to close the gap between assets and liabilities that allow them to keep lending. That's why the debt crisis has potentially major ramifications for the entire European economy. We should be worrried; very worried.

When you think about it, the correlation between the high point of this oil price cycle and Greece's current troubles makes perfect sense. As the cost of running public services is driven up slightly by the price of oil, the budget (arranged when the price per barrell was substantially lower) just won't make ends meet. As you may have noticed, the oil price bubble seems to have stagnated, falling from $125 p/b to $115 p/b over the last month. Those investors who were riding the gravy train upwards now need a new source of income to compensate for the declining value of their oil asset. What better than to pick on the weakest kid and sell greek debt to drive up yields (and then arrange to re purchase them at higher interest with convenient conditions attatched)...

The country is now on the brink of bankruptcy- with yields (effectively interst rates) on 2 year debt up to 28% p/a. There is simply no way the Greek government can afford to borrow any more money. The ponzi scheme is over. Greece is now living off pay day loans, and the loan shark is bringing out the baseball bat. On a back of the paper calculation, Greece would have to start growing 15% a year to possibly sustain its current debt burden without immediate assistance. They're currently in a 6% a year recession.

In the UK, figures just released show retail sales slumped 1.4% in May. Did I predict that one of the symptoms of the coming crash would be a decline in retail sale volumes? Essentially yes; I argued that one of the factors in the 2008 crash was a decline in retail shares- obviously linked to sales- in turn linked to the "credit crunch"- and most importantly, oil. None of these signs bode well for anyone. The market is more vulnerable now than it was in 2008, like a rabbit in a tiger cage, all it can hope for is that the tiger start fighting each other over it, and it can escape in the meantime. The analogy here is that the different economic jitters we face right now could to some extent offset each other. If growth stumbles, inflation will too, and so might interstest rates on European debt. However, it's almost inconveicably unlikely that the right "balance" between the different crisis will come about by chance. Investors are acting with a predator mentality with no regard for sustainability in their decision making. "Every man for himself" pretty much sums up the current situation.

A greek default could be significant enough to wipe out enough of bank balance sheets to close the gap between assets and liabilities that allow them to keep lending. That's why the debt crisis has potentially major ramifications for the entire European economy. We should be worrried; very worried.

Monday 6 June 2011

Shock horror, cutting carbon could worsen global warming!

It is the exhortation of the politically correct media and left wing politicians that reducing carbon emissions will reduce the rate of average global warming. However, after much investigating I have found that this little polemic falls foul of a classic academic assumption that I detest. This is the "ceteris paribus" assumption, a Latin phrase that literally means "everything else being equal". The big black hole in the carbon myth is that everything else is not equal.

Before we delve further into the wonders of this inconvenient truth, I must declare that I am NOT a climate skeptic. The science behind the IPCC forecasts is solid, but what is not so solid is the economics behind it. The IPCC's emissions scenarios, which project future fossil fuel consumption are only made possible by the data of the International Energy Agency on reserves of these fuels. I hasten to add that countless environmentalists have poured scorn over the IEA's information, and with good reason- the IEA simply trusts declared reserves given to them by the various countries which they survey. These reserve figures are known to be a political artifact, fraudulently inflated to boost asset values (read: "investor confidence").

Now it might seem that this is irrelevant. If the IEA has exaggerated reserves, then we won't be able to emit the disastrous quantities of carbon that the IPCC's projected emissions scenarios rely on. On the other hand, if the IEA's reserves are correct, then climate change is still game on. However, things are not quite as simple as this.

The burning of fossil fuels contributes to concentrations of aerosol chemicals in the atmosphere, which have a short term cooling effect. Because they don't last long, the atmospheric concentration is highly responsive to changes in emissions. Carbon dioxide, on the other hand, has a long term heating effect, but unlike aerosol's, if you were to cease emissions, the atmospheric concentration would not rapidly plummet. The total radiative heating effect of all greenhouse gases is (2005) 2.45 W/M^2 (watts per meters squared) with a range of 2.18 to 2.7. However, this needs to be adjusted for the cooling effect of atmospheric aerosol, which gives us a figure of 1.41 W/M^2 with a range of 0.41 to 2.2. For the sake of transparency, I have calculated these from the parts per million concentrations of greenhouse gas equivalents and atmospheric aerosol's at http://www.skepticalscience.com/carbon-dioxide-equivalents.html (pro global warming site) and the IPCC's (pro global warming) formula of 5.35*log(new concentration/288)= radiative heating effect.

It is immediately apparent that drastic emission cuts would also lead to a collapse in the cooling effect of atmospheric aerosol's - to disastrous consequences- something that environmentalist James Lovelock lucidly explains in his book "The Vanishing Face of Gaia". Using the mid range figures, there would be a warming effect of 1.04 extra W/M^2, compared to today. The warming effect of the loss of atmospheric cooling aerosol's would ironically be greater than all the warming effect of greenhouse gas pollution in the last 35 years, except it would be much more sudden. It is proposed that carbon emissions are reduce by 80% on 1990 levels by 2050, although, for the sake of argument, let's say we were to eliminate them all within 10 years. The saving in terms of the prevented rise in carbon dioxide equivalents excluding aerosol would be in the order of 30 parts per million, yet the overall increase in total atmospheric forcing would be greater than the saving made by reducing greenhouse gas emissions.

According to data table 6.1 of the IPCC's most recent global warming study (2005 data), the total forcing of aerosols is -1.2, whereas the positive forcing of long lived greenhouse gases (Carbon Dioxide, Methane, Nitrous Oxide, and tropospheric Ozone) is 2.65. Halocarbons add an additional 0.34 W/M^2 but these have short term lifespans and are in any case being successfully and rapidly phases out so in the long term they are essentially an irrelevance. It is however misleading to give real figures, since what is really relevant is the change. For instance, the sun has an enormous forcing (over 1300) but the long term changes are very small. Around 1/2 of the forcing effect of the long lived greenhouse gases (LLGHGS) is of anthropogenic (man made) origin- there were lots of them there before we polluted the atmosphere with some extra. Overall, the positive forcing anthropogenic LLGHGS is balanced out by anthropogenic aerosols. The warming of the 21st century is attributable to the net difference between the two that only occurs due to short term minor greenhouse gases that are being phased out. We should, in other words, expect to see a reversal of the warming trend as the positive forcings decrease to match the level of negative forcings over the next few decades as the short term gases are phased out and disappear from the atmosphere. However, there is incessant political will to reduce LLGHG emissions, and thus stop the industrial processes associated with them that keep up the aerosol levels. The 21st century warming, of 0.8 deg C, attributable to the net forcing of 0.3-1 W/M^2 could be dwarfed if aerosol levels fell, leaving humanity, in Lovelock's words, to feel "the full force" (sic) of the anthropogenic greenhouse effect.

No matter how fast emissions cuts are carried out, the collapse of atmospheric aerosol concentrations is a long term inevitability. Interestingly, the IPCC does not give a forecast for these, even though it gives a forecast for all other radiative heating/cooling gases. Despite this being extremely mysterious, it only highlights the fact that a big jump in total CO2 equivalents from the figure including aerosol cooling to the figure excluding it. That would already put us on course for the 2 degree warming everyone is trying to avoid. Somebody has messed up big time with the plan to save the planet by reducing GHG emissions. It seems we really are stuck between a rock and a hard place.

Before we delve further into the wonders of this inconvenient truth, I must declare that I am NOT a climate skeptic. The science behind the IPCC forecasts is solid, but what is not so solid is the economics behind it. The IPCC's emissions scenarios, which project future fossil fuel consumption are only made possible by the data of the International Energy Agency on reserves of these fuels. I hasten to add that countless environmentalists have poured scorn over the IEA's information, and with good reason- the IEA simply trusts declared reserves given to them by the various countries which they survey. These reserve figures are known to be a political artifact, fraudulently inflated to boost asset values (read: "investor confidence").

Now it might seem that this is irrelevant. If the IEA has exaggerated reserves, then we won't be able to emit the disastrous quantities of carbon that the IPCC's projected emissions scenarios rely on. On the other hand, if the IEA's reserves are correct, then climate change is still game on. However, things are not quite as simple as this.

The burning of fossil fuels contributes to concentrations of aerosol chemicals in the atmosphere, which have a short term cooling effect. Because they don't last long, the atmospheric concentration is highly responsive to changes in emissions. Carbon dioxide, on the other hand, has a long term heating effect, but unlike aerosol's, if you were to cease emissions, the atmospheric concentration would not rapidly plummet. The total radiative heating effect of all greenhouse gases is (2005) 2.45 W/M^2 (watts per meters squared) with a range of 2.18 to 2.7. However, this needs to be adjusted for the cooling effect of atmospheric aerosol, which gives us a figure of 1.41 W/M^2 with a range of 0.41 to 2.2. For the sake of transparency, I have calculated these from the parts per million concentrations of greenhouse gas equivalents and atmospheric aerosol's at http://www.skepticalscience.com/carbon-dioxide-equivalents.html (pro global warming site) and the IPCC's (pro global warming) formula of 5.35*log(new concentration/288)= radiative heating effect.

It is immediately apparent that drastic emission cuts would also lead to a collapse in the cooling effect of atmospheric aerosol's - to disastrous consequences- something that environmentalist James Lovelock lucidly explains in his book "The Vanishing Face of Gaia". Using the mid range figures, there would be a warming effect of 1.04 extra W/M^2, compared to today. The warming effect of the loss of atmospheric cooling aerosol's would ironically be greater than all the warming effect of greenhouse gas pollution in the last 35 years, except it would be much more sudden. It is proposed that carbon emissions are reduce by 80% on 1990 levels by 2050, although, for the sake of argument, let's say we were to eliminate them all within 10 years. The saving in terms of the prevented rise in carbon dioxide equivalents excluding aerosol would be in the order of 30 parts per million, yet the overall increase in total atmospheric forcing would be greater than the saving made by reducing greenhouse gas emissions.

According to data table 6.1 of the IPCC's most recent global warming study (2005 data), the total forcing of aerosols is -1.2, whereas the positive forcing of long lived greenhouse gases (Carbon Dioxide, Methane, Nitrous Oxide, and tropospheric Ozone) is 2.65. Halocarbons add an additional 0.34 W/M^2 but these have short term lifespans and are in any case being successfully and rapidly phases out so in the long term they are essentially an irrelevance. It is however misleading to give real figures, since what is really relevant is the change. For instance, the sun has an enormous forcing (over 1300) but the long term changes are very small. Around 1/2 of the forcing effect of the long lived greenhouse gases (LLGHGS) is of anthropogenic (man made) origin- there were lots of them there before we polluted the atmosphere with some extra. Overall, the positive forcing anthropogenic LLGHGS is balanced out by anthropogenic aerosols. The warming of the 21st century is attributable to the net difference between the two that only occurs due to short term minor greenhouse gases that are being phased out. We should, in other words, expect to see a reversal of the warming trend as the positive forcings decrease to match the level of negative forcings over the next few decades as the short term gases are phased out and disappear from the atmosphere. However, there is incessant political will to reduce LLGHG emissions, and thus stop the industrial processes associated with them that keep up the aerosol levels. The 21st century warming, of 0.8 deg C, attributable to the net forcing of 0.3-1 W/M^2 could be dwarfed if aerosol levels fell, leaving humanity, in Lovelock's words, to feel "the full force" (sic) of the anthropogenic greenhouse effect.

No matter how fast emissions cuts are carried out, the collapse of atmospheric aerosol concentrations is a long term inevitability. Interestingly, the IPCC does not give a forecast for these, even though it gives a forecast for all other radiative heating/cooling gases. Despite this being extremely mysterious, it only highlights the fact that a big jump in total CO2 equivalents from the figure including aerosol cooling to the figure excluding it. That would already put us on course for the 2 degree warming everyone is trying to avoid. Somebody has messed up big time with the plan to save the planet by reducing GHG emissions. It seems we really are stuck between a rock and a hard place.

Friday 3 June 2011

Shale gas puts trick in magic trick.

1000 years of supply, 10000 years of supply, who knows. Some of the claims that are being banded about about the big shale gas plays would make the return of Christ seem unexciting by comparison. It is not often mentioned that the energy return on investment for shale gas is so negligibly positive at best, that you'd have to reinvest equivalent to say 95% of the resource just in getting it all out of the ground; and that's if there is any "ground" left after you have blown it to smithereens and polluted it to hell with the extraction process.

Hydraulic fracturing, the literally explosive process by which gas can be extracted from tight shale bed rock has been available since the 60s, as have all of the companies that you would regard as "big oil"- household names like BP, Exxon, Shell, Total, and so on. Proponents of shale gas claim that "new technology" has opened up shale bed gas as a new resource, which is nonsense. The big oil companies new how to do it all along, the just didn't want to do it, it doesn't make money.

The "frack job" of almost sexually inappropriate proportions by drilling company "Caudrilla" in Blackpool, England, has been revealed as the cause of two EARTHQUAKES last week, and has been put on hold (no surprise). Shale gas is already the culprit of (severe) groundwater toxic pollution- which occurs when the chemicals in the fracking solution permeate through porous rock into underground groundwater aquifiers - and is thought to cause as much as 2.5 times as much greenhouse gas pollution than coal, but now it causes earthquakes as well, whatever next! No wonder big oil has avoided it like the plague.

Shale gas "discoveries" allowed the IEA (International Energy Agency) to double it's numbers for global gas reserves, not that the shale gas had magically appeared, it had just been declared recoverable due to the entry of shale gas drilling firms into the market. To outside observers, it might have seemed as if the IEA had some sort of magic wand when it came to gas reserves, how could a finite resource always increase in size?

The oil as gas companies are responsible for the reserve growth miracle. It's not that they discover the oil/gas, it was nearly all discovered decades ago, they just keep enough of it in their back pocket to declare in the future, that way they can always (appear to) offset production with new discoveries. The word discoveries should be substituted for "revelations"; more appropriate for the conjuring trick style business they get up to with the numbers. You don't have to look far to find the oil companies boasting about the miracle of reserve growth, each year their annual reports are plastered with factoids explain that they have more than last year, despite production, without explaining how the magic trick works.

It's common sense that if shale gas was profitable, big oil would have got in the game years ago, their geologists knew about the reserves and they had the technology. The fact that the shale gas boom has minions such as Caudrilla in the UK and Chesapeak Energy in the US at the helm is testament to the equally magical nature of the modern business system. I muse that these companies only need the "prospect" that shale gas delivers to convince the gullible banksters to lend them some money. Before long, governments will hopefully make the sensible decision to ban shale gas drilling and avoid runaway climate change (if that is still possible). In doing so, they'll crash the boom and destroy a hefty chunk of those loans that Caudrilla and Chesapeak won't be able to repay, unless they really can do magic.

Hydraulic fracturing, the literally explosive process by which gas can be extracted from tight shale bed rock has been available since the 60s, as have all of the companies that you would regard as "big oil"- household names like BP, Exxon, Shell, Total, and so on. Proponents of shale gas claim that "new technology" has opened up shale bed gas as a new resource, which is nonsense. The big oil companies new how to do it all along, the just didn't want to do it, it doesn't make money.

The "frack job" of almost sexually inappropriate proportions by drilling company "Caudrilla" in Blackpool, England, has been revealed as the cause of two EARTHQUAKES last week, and has been put on hold (no surprise). Shale gas is already the culprit of (severe) groundwater toxic pollution- which occurs when the chemicals in the fracking solution permeate through porous rock into underground groundwater aquifiers - and is thought to cause as much as 2.5 times as much greenhouse gas pollution than coal, but now it causes earthquakes as well, whatever next! No wonder big oil has avoided it like the plague.

Shale gas "discoveries" allowed the IEA (International Energy Agency) to double it's numbers for global gas reserves, not that the shale gas had magically appeared, it had just been declared recoverable due to the entry of shale gas drilling firms into the market. To outside observers, it might have seemed as if the IEA had some sort of magic wand when it came to gas reserves, how could a finite resource always increase in size?

The oil as gas companies are responsible for the reserve growth miracle. It's not that they discover the oil/gas, it was nearly all discovered decades ago, they just keep enough of it in their back pocket to declare in the future, that way they can always (appear to) offset production with new discoveries. The word discoveries should be substituted for "revelations"; more appropriate for the conjuring trick style business they get up to with the numbers. You don't have to look far to find the oil companies boasting about the miracle of reserve growth, each year their annual reports are plastered with factoids explain that they have more than last year, despite production, without explaining how the magic trick works.

It's common sense that if shale gas was profitable, big oil would have got in the game years ago, their geologists knew about the reserves and they had the technology. The fact that the shale gas boom has minions such as Caudrilla in the UK and Chesapeak Energy in the US at the helm is testament to the equally magical nature of the modern business system. I muse that these companies only need the "prospect" that shale gas delivers to convince the gullible banksters to lend them some money. Before long, governments will hopefully make the sensible decision to ban shale gas drilling and avoid runaway climate change (if that is still possible). In doing so, they'll crash the boom and destroy a hefty chunk of those loans that Caudrilla and Chesapeak won't be able to repay, unless they really can do magic.

Tuesday 31 May 2011

Welcome to the climate casino! Good luck.

Everyone knows that smoking causes cancer, sure, not in all cases, and sure, it's not quite proven, but since the 1950s we've known that there is a damn good correlation between those death sticks and, well, dying. As it happens, climate change is not strictly speaking "proven", but since the world has been warming up in correlation with greenhouse gas emissions from pre-indsutrial times, you'd be pretty stupid to deny the link. The correlation could be a coincidence, sure. As could the correlation between lung cancer deaths and smokers. Big coincidence don't you think? Oh boy, looks like that link between greenhouse gases and temperature stretches back millions of years. Must be an even bigger coincidence!

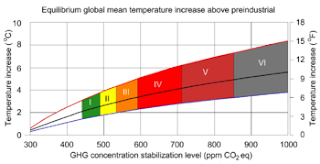

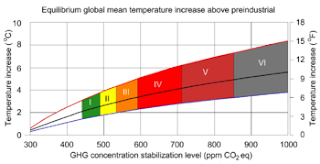

This graph could define the climate change debate in the coming years, at least until the IPCC (Intergovernmental Panel on Climate Change) publishes its next assessment report, due in 2014.

It is commonly believed by those who think they know, that the concentration of Carbon Dioxide in the atmosphere is around 390 parts per million (PPM) giving us a good chance of avoiding dangerous climate change that will occur above 2-3 degrees. It is perfectly true that the concetration of CO2 in the atmosphere is about 390 PPM, but assuming that we still have time to stabilize this concetration at safe levels is based on a misinterpretation of the graph. Yesterday, the Guardian reported that even the 2 degree target that world leaders are prepared to risk is almost out of reach, with the International Energy Association's chief economist, Fatih Birol, commenting that it was a "nice utopia". In reality, the "exclusive" nature of the Guardian's report was slightly out of date.

If you look carefully at the graph, it does not actually measure CO2 at all, it measures something called "CO2 eq", which basically means all greenhouse gases, including for instance methane and CFCs. The potency of these emissions are also measured and adjusted as if they were CO2 to give a ballpark figure for the total amount of greenhouse gases in the atmosphere. The blue line on the graph shows the lowest conceivable eventual average global temperature increase for a given CO2 eq stabilization level (and were not even stable yet), the red line shows the highest, and the black line is what is expected. Given that the concentration of CO2 eq is not 390 PPM, but a frightening 470 PPM or thereabouts (the latest figures I had were two years old so I had to conservatively continue the trend to get this number but It makes little difference) you can see we have almost no chance of meeting the 2 degree target. It could even be worse than that. I collected as much information I could on previous CO2 eq calculations, and was only able to find them from 2001, 2004, 2007, and 2008. The picture is clear, the concentration is increasing exponentially. Between 01 and 04 it rose 4.33 parts per million per year, from 412 to 415, from 04 to 07 it rose 6.66 parts per million per year, from 425 to 445, from 2007 to 2008 it rose another 19 parts per million, and I have no figures after that but it could be over 500 now. Fatih Birol's "nice utopia" comment satisfies polite standards of newsprint but it would be clearer to say that we haven't got a f**k's chance in hell.

Have they, the politicians, given up? Or is the just some sort of nightmarish mistake? Furthermore, the concentration of CO2 eq is rising more than twice, possibly three times as quick as the concetration of CO2 alone. The rise cannot just be accounted for by anthropogenic (human) emissions, which indicates that natural "positive feedbacks" such as the melting of artic permafrost (which contains methane) have already begun. This is truly terrifying. As Nafeez Ahmed explains in this recent (and excellent) book - "A user's guide to the crisis of civilization" - CO2 eq concentrations rose from 425 PPM to 445 PPM from 2004 to 2007. (4.7% a year). CO2 concentrations alone rose 0.7% a year. However, human emissions of CO2 are much more significant than human emissions of the other greenhouse gases that account for the difference between CO2 alone and the CO2 eq figure, so the increased rate of change is probably driven by natural emissions of methane. Anthropogenic emissions of other greenhouse gases beyond CO2 and Methane are mostly falling, so it seems as if we have entered the era of runnaway climate change. Is that why they are not bothering to do anything about it?

Suppose we completely eliminated Carbon Dioxide emissions immediately. Of course, this is impossible, but let's be optimistic. Very optimistic. We would elimiate just 0.7% of the 4.7% a year rise in CO2 eq atmospheric concetrations, the stuff that really matters.

If I haven't made any big mistakes, then there is clearly little point in bothering about a low carbon economy any more. Even geoengineering, most viable forms of which remove only CO2, not the others, from the air, isn't going to address the problem of seemingly runaway natural methane emissions. Some clever clogs better think up a way of solving this problem or the shit is going to hit the fan big time. Be preapared. They probably won't. Firstly, hardly anybody understands the real problem, they are focusing on the out of date problem of carbon emisisons. Secondly, nobody who does understand has the money to do anything worthwhile.

So it is clear, either the people who run the world made a horrible mistake by focusing on CO2 when it wasn't the whole problem, or they knew, but couldn't be bothered to do anything about it for political reasons, in which case you can hardly blame the people who voted for them. Sure, many were gullible, but it's hardly as if they were well informed by the media. The best selling newspapers frequently run articles denying climate change. Most (in fact nearly all) of the worlds poor had never even heard of the damn thing, and it's hardly as if they were to blame anyway. Sooner or later, people are going to start getting very angry. The blame game could be nasty, but if it is direct at the right people, it serves them right.

When I was much younger, I remember my Dad once told me that we might only have 10 years to fix the climate. You can imagine why I was puzzled that as I grew up, the news continued to say that we had 10 years, for at least 10 years. Had time stopped, no, I suspect they just didn't want to admit that it was runnig out. Either that or they were just stupid. That was at least 10 years ago. I hope they were stupid; ignorance is far preferable than maliciousness, but something tells me that they thought they were trying to be kind by not telling people quite how bad it was. For years, I went along, pretending to myself that we still had time. Yet gradually I began to realise that we didn't. It seemed as if whatever anybody did or said, nobody would listen. Ok, a few did, but not enough, not nearly enough. I was astonished that the Green movement thought that just because one book had failed to bring about change, another would. Sure, climate change gained "prominence", but this didn't translate into any meaningfull action on a global scale. I guess people were niave to think that they could change the world. Despite what the globalists say, it really is much bigger than it was in the past. It's more difficult to get 7 billion people to act than 2 billion. The little people weren't to blame anyway. It was hardly as if they knew. How could they be expected to discern between the truth of the green movement and the bombardment of corporate sponsored media misinformation on climate change. Most of them weren't even literate.

In terms of who is to blame, it is the people who run the world, as well as the rich few who elect and finance them. I suppose you can't blame their "live for the moment" attitude, but you can certainly blame their ridiculous refusal to convert their lifestyle into a low carbon one, which would have been just as pleasant. Still, most of the rich few who caused the trouble didn't know. The worker zombies of the west were so overburdened with the hasseles of modern life, they were physchologically imprisoned by an elaborate daily routine predicated upon individualist economic competition. How were they supposed to learn about climate change if they didn't even have time after work to make a proper dinner, and had to have take-aways or ready meals?

The coming climate crisis brings with it many risks. We mustn't let anybody who doesn't deserve the blame recieve it, since this could lead to war, as it did in the late 1930s when the Jewish people of Germany were made scapegoats for the global economic crisis.

Far more terrifying than any political ramifications is the guarantee that exceeding the 2-3 degree tipping point means at least 4-8 degrees of warming above pre-industrial temperatures by the end of the century. Pre-industrial global temperatures averaged 13.5 degrees celcius, so average global temperature by the end of the century could exceed 20 degrees. That would burn the rainforests, melt the last remaining ice from the ice caps, and fry the planet. Forest loss could add a further 600 parts per million to the atmopshere, taking the total concentration far beyond 1000 parts per million, when all the other positive feedbacks are factored in, the planet would truly roast, and humans would die like a lobster in a bioling saucepan. Average global temperatures of 20 degrees celcius or more may not seem to bad, but when you consider that is an average, meaning that a distribution curve of days/frequency against temperature would show almost no cold days and lots of roasting hot days, there would never be enough time for water to be absorbed by the land before it evaporated, maing it near impossible to grow crops, let alone rer animals (which eat them) in almost every part of the world apart from the poles. Climate justice? You betcha!

This graph could define the climate change debate in the coming years, at least until the IPCC (Intergovernmental Panel on Climate Change) publishes its next assessment report, due in 2014.

It is commonly believed by those who think they know, that the concentration of Carbon Dioxide in the atmosphere is around 390 parts per million (PPM) giving us a good chance of avoiding dangerous climate change that will occur above 2-3 degrees. It is perfectly true that the concetration of CO2 in the atmosphere is about 390 PPM, but assuming that we still have time to stabilize this concetration at safe levels is based on a misinterpretation of the graph. Yesterday, the Guardian reported that even the 2 degree target that world leaders are prepared to risk is almost out of reach, with the International Energy Association's chief economist, Fatih Birol, commenting that it was a "nice utopia". In reality, the "exclusive" nature of the Guardian's report was slightly out of date.

If you look carefully at the graph, it does not actually measure CO2 at all, it measures something called "CO2 eq", which basically means all greenhouse gases, including for instance methane and CFCs. The potency of these emissions are also measured and adjusted as if they were CO2 to give a ballpark figure for the total amount of greenhouse gases in the atmosphere. The blue line on the graph shows the lowest conceivable eventual average global temperature increase for a given CO2 eq stabilization level (and were not even stable yet), the red line shows the highest, and the black line is what is expected. Given that the concentration of CO2 eq is not 390 PPM, but a frightening 470 PPM or thereabouts (the latest figures I had were two years old so I had to conservatively continue the trend to get this number but It makes little difference) you can see we have almost no chance of meeting the 2 degree target. It could even be worse than that. I collected as much information I could on previous CO2 eq calculations, and was only able to find them from 2001, 2004, 2007, and 2008. The picture is clear, the concentration is increasing exponentially. Between 01 and 04 it rose 4.33 parts per million per year, from 412 to 415, from 04 to 07 it rose 6.66 parts per million per year, from 425 to 445, from 2007 to 2008 it rose another 19 parts per million, and I have no figures after that but it could be over 500 now. Fatih Birol's "nice utopia" comment satisfies polite standards of newsprint but it would be clearer to say that we haven't got a f**k's chance in hell.

Have they, the politicians, given up? Or is the just some sort of nightmarish mistake? Furthermore, the concentration of CO2 eq is rising more than twice, possibly three times as quick as the concetration of CO2 alone. The rise cannot just be accounted for by anthropogenic (human) emissions, which indicates that natural "positive feedbacks" such as the melting of artic permafrost (which contains methane) have already begun. This is truly terrifying. As Nafeez Ahmed explains in this recent (and excellent) book - "A user's guide to the crisis of civilization" - CO2 eq concentrations rose from 425 PPM to 445 PPM from 2004 to 2007. (4.7% a year). CO2 concentrations alone rose 0.7% a year. However, human emissions of CO2 are much more significant than human emissions of the other greenhouse gases that account for the difference between CO2 alone and the CO2 eq figure, so the increased rate of change is probably driven by natural emissions of methane. Anthropogenic emissions of other greenhouse gases beyond CO2 and Methane are mostly falling, so it seems as if we have entered the era of runnaway climate change. Is that why they are not bothering to do anything about it?

Suppose we completely eliminated Carbon Dioxide emissions immediately. Of course, this is impossible, but let's be optimistic. Very optimistic. We would elimiate just 0.7% of the 4.7% a year rise in CO2 eq atmospheric concetrations, the stuff that really matters.

If I haven't made any big mistakes, then there is clearly little point in bothering about a low carbon economy any more. Even geoengineering, most viable forms of which remove only CO2, not the others, from the air, isn't going to address the problem of seemingly runaway natural methane emissions. Some clever clogs better think up a way of solving this problem or the shit is going to hit the fan big time. Be preapared. They probably won't. Firstly, hardly anybody understands the real problem, they are focusing on the out of date problem of carbon emisisons. Secondly, nobody who does understand has the money to do anything worthwhile.

So it is clear, either the people who run the world made a horrible mistake by focusing on CO2 when it wasn't the whole problem, or they knew, but couldn't be bothered to do anything about it for political reasons, in which case you can hardly blame the people who voted for them. Sure, many were gullible, but it's hardly as if they were well informed by the media. The best selling newspapers frequently run articles denying climate change. Most (in fact nearly all) of the worlds poor had never even heard of the damn thing, and it's hardly as if they were to blame anyway. Sooner or later, people are going to start getting very angry. The blame game could be nasty, but if it is direct at the right people, it serves them right.

When I was much younger, I remember my Dad once told me that we might only have 10 years to fix the climate. You can imagine why I was puzzled that as I grew up, the news continued to say that we had 10 years, for at least 10 years. Had time stopped, no, I suspect they just didn't want to admit that it was runnig out. Either that or they were just stupid. That was at least 10 years ago. I hope they were stupid; ignorance is far preferable than maliciousness, but something tells me that they thought they were trying to be kind by not telling people quite how bad it was. For years, I went along, pretending to myself that we still had time. Yet gradually I began to realise that we didn't. It seemed as if whatever anybody did or said, nobody would listen. Ok, a few did, but not enough, not nearly enough. I was astonished that the Green movement thought that just because one book had failed to bring about change, another would. Sure, climate change gained "prominence", but this didn't translate into any meaningfull action on a global scale. I guess people were niave to think that they could change the world. Despite what the globalists say, it really is much bigger than it was in the past. It's more difficult to get 7 billion people to act than 2 billion. The little people weren't to blame anyway. It was hardly as if they knew. How could they be expected to discern between the truth of the green movement and the bombardment of corporate sponsored media misinformation on climate change. Most of them weren't even literate.

In terms of who is to blame, it is the people who run the world, as well as the rich few who elect and finance them. I suppose you can't blame their "live for the moment" attitude, but you can certainly blame their ridiculous refusal to convert their lifestyle into a low carbon one, which would have been just as pleasant. Still, most of the rich few who caused the trouble didn't know. The worker zombies of the west were so overburdened with the hasseles of modern life, they were physchologically imprisoned by an elaborate daily routine predicated upon individualist economic competition. How were they supposed to learn about climate change if they didn't even have time after work to make a proper dinner, and had to have take-aways or ready meals?

The coming climate crisis brings with it many risks. We mustn't let anybody who doesn't deserve the blame recieve it, since this could lead to war, as it did in the late 1930s when the Jewish people of Germany were made scapegoats for the global economic crisis.

Far more terrifying than any political ramifications is the guarantee that exceeding the 2-3 degree tipping point means at least 4-8 degrees of warming above pre-industrial temperatures by the end of the century. Pre-industrial global temperatures averaged 13.5 degrees celcius, so average global temperature by the end of the century could exceed 20 degrees. That would burn the rainforests, melt the last remaining ice from the ice caps, and fry the planet. Forest loss could add a further 600 parts per million to the atmopshere, taking the total concentration far beyond 1000 parts per million, when all the other positive feedbacks are factored in, the planet would truly roast, and humans would die like a lobster in a bioling saucepan. Average global temperatures of 20 degrees celcius or more may not seem to bad, but when you consider that is an average, meaning that a distribution curve of days/frequency against temperature would show almost no cold days and lots of roasting hot days, there would never be enough time for water to be absorbed by the land before it evaporated, maing it near impossible to grow crops, let alone rer animals (which eat them) in almost every part of the world apart from the poles. Climate justice? You betcha!

Sunday 29 May 2011

Stuck between a rock and a hard place.

This is the second post I've written today; and that's the first time I've ever written two posts in a day. I have been writing about two converging crisis - peak oil and climate change - on this blog, as well as various political and economic happenings for a while now, but this evening I put two and two together and had the most horrific brainwave. I'll explain it as clear as I can.

You might have already realised part of the conundrum, that peak oil and climate change might seem mutually exclusive. If we are unprepared for the peaking of the flow of oil to world markets, the global economy could collapse. It nearly did in 2008, only just saved by emergency action by government's to bail out the banking system. That shows that when disaster looms, we can fix big shit. However, if our economy is brought down by a resource crisis of one form or another, that might save us from the impending (and to some extent arleady occuring) climate crisis, right? Wrong.

In fact, I realised, to my absolute horror, that James Lovelock is right in his book, "The Vanishing Face of Gaia", that if we stopped burning fossil fuels immediately the atmospheric aerosol that is provided as a side effect of burning fossil fuels would fall out of the atmosphere within weeks if you stopped burning them, leaving the earth exposed to the warming stored up by the emissions of the last 100 years that are still "in the system". Admittedly we wouldn't be in for any more warning after we had paid the overdue debt of past emissions, but it demonstrates what might happen if we do reduce emissions.

Suppose the "continued growth" path is the hard place. The next 100 years will see unprecedented global climate change that will obliterate much of current human civilization. Suppose the "collapse" scenario is the "rock", the next 10-20 years or sooner could see a resource crisis bring down the global economy, and carbon emissions with it, and in turn atmospheric aerosoles with it, exposing the earth to the full force of the greenhouse effect that we are actually to some extent insulated from at the moment.

It feels odd to be aware of a problem, the solution to which might make the problem worse. This paradox paralyses the mind in a strange way. Essentially the faster we reduce emissions the faster short term climate change occurs, but the less of it we have in the long term. The slower we reduce emissions the slower short term climate change occurs but the more of it happens in the long term? I'd be interested to recieve feedback from anyone who comes accross this post who knows anything about the subject. Sadly, I suspect not many of you do.

You might have already realised part of the conundrum, that peak oil and climate change might seem mutually exclusive. If we are unprepared for the peaking of the flow of oil to world markets, the global economy could collapse. It nearly did in 2008, only just saved by emergency action by government's to bail out the banking system. That shows that when disaster looms, we can fix big shit. However, if our economy is brought down by a resource crisis of one form or another, that might save us from the impending (and to some extent arleady occuring) climate crisis, right? Wrong.

In fact, I realised, to my absolute horror, that James Lovelock is right in his book, "The Vanishing Face of Gaia", that if we stopped burning fossil fuels immediately the atmospheric aerosol that is provided as a side effect of burning fossil fuels would fall out of the atmosphere within weeks if you stopped burning them, leaving the earth exposed to the warming stored up by the emissions of the last 100 years that are still "in the system". Admittedly we wouldn't be in for any more warning after we had paid the overdue debt of past emissions, but it demonstrates what might happen if we do reduce emissions.

Suppose the "continued growth" path is the hard place. The next 100 years will see unprecedented global climate change that will obliterate much of current human civilization. Suppose the "collapse" scenario is the "rock", the next 10-20 years or sooner could see a resource crisis bring down the global economy, and carbon emissions with it, and in turn atmospheric aerosoles with it, exposing the earth to the full force of the greenhouse effect that we are actually to some extent insulated from at the moment.

It feels odd to be aware of a problem, the solution to which might make the problem worse. This paradox paralyses the mind in a strange way. Essentially the faster we reduce emissions the faster short term climate change occurs, but the less of it we have in the long term. The slower we reduce emissions the slower short term climate change occurs but the more of it happens in the long term? I'd be interested to recieve feedback from anyone who comes accross this post who knows anything about the subject. Sadly, I suspect not many of you do.

Just how stupid can you get?

There has been a flurry of articles over the last week or so about "synthetic meat"- first in the BBC's flagship science and technology magazine "BBC Focus", and now in the Guardian newspaper and the Daily Mail.

An animal converts resources into meat. A factory full of petri dishes could be used as a substitute for the animal, but obviously it would be even more inefficient. To claim that synthetic meat would "offset carbon emissions" is either a lie, or it just highlights the unthinking nature of the media. Perhaps I am missing something, Is the synthetic meat frenzy a joke? It certainly isn't a very funny one.

Much funnier is the fact that synthetic meat would inevitably require more factor inputs to produce ounce for ounce than normal meat. Sure, animals are inefficient, they convert less than 10% of the food you feed them into the food you get from them. But where exactly are you going to have all these synthetic meat making machines? In a farm? I didn't think so. It requires little more than an elementary knowledge of biology to realize that cells don't just grow from thin air. You have to feed them. Synthetic meat would be machine fed, and machines require energy and maintenance. You can't just feed the synthetic meat cultures with other synthetic meat, since there is always an energy loss, so doing so would leave you with less than you started with. Clever.

You're going to have to feed the synthetic meat with some sort of vegetable matter, which can't be grown in vats because it needs to photosynthesize out in the sun, so in the end you would be using just as much land to grow the food to feed the meat. Alternatively, your "growth serum"- essentially the food you feed the synthetic meat cells could be made from mined minerals, but they are finite resources, and making our food production system reliant on such things would axiomatically make the food itself a finite resource. There are no renewable sources of food for synthetic meat that do not subtract a greater amount from the overall world food supply than the synthetic meat generates. Some have described synthetic meat as more "ethical" because it does not involve the slaughter of animals. Fair enough, but since it deprives more humans of meat, it is ridiculous to call it ethical. WOW synthetic meat avoids the slaughter of real animals so it is "ethical" but it results in the starvation of humans! OH...

You might save a bit of land because the growing of the meat itself is done in a more compact way than the conventional rearing of animals on farms, but you presumably sacrifice the extra energy that a factory uses above a farm. Then again, most modern meat farms are practically factories. Synthetic meat surely isn't worth much attention.

An animal converts resources into meat. A factory full of petri dishes could be used as a substitute for the animal, but obviously it would be even more inefficient. To claim that synthetic meat would "offset carbon emissions" is either a lie, or it just highlights the unthinking nature of the media. Perhaps I am missing something, Is the synthetic meat frenzy a joke? It certainly isn't a very funny one.

Much funnier is the fact that synthetic meat would inevitably require more factor inputs to produce ounce for ounce than normal meat. Sure, animals are inefficient, they convert less than 10% of the food you feed them into the food you get from them. But where exactly are you going to have all these synthetic meat making machines? In a farm? I didn't think so. It requires little more than an elementary knowledge of biology to realize that cells don't just grow from thin air. You have to feed them. Synthetic meat would be machine fed, and machines require energy and maintenance. You can't just feed the synthetic meat cultures with other synthetic meat, since there is always an energy loss, so doing so would leave you with less than you started with. Clever.

You're going to have to feed the synthetic meat with some sort of vegetable matter, which can't be grown in vats because it needs to photosynthesize out in the sun, so in the end you would be using just as much land to grow the food to feed the meat. Alternatively, your "growth serum"- essentially the food you feed the synthetic meat cells could be made from mined minerals, but they are finite resources, and making our food production system reliant on such things would axiomatically make the food itself a finite resource. There are no renewable sources of food for synthetic meat that do not subtract a greater amount from the overall world food supply than the synthetic meat generates. Some have described synthetic meat as more "ethical" because it does not involve the slaughter of animals. Fair enough, but since it deprives more humans of meat, it is ridiculous to call it ethical. WOW synthetic meat avoids the slaughter of real animals so it is "ethical" but it results in the starvation of humans! OH...

You might save a bit of land because the growing of the meat itself is done in a more compact way than the conventional rearing of animals on farms, but you presumably sacrifice the extra energy that a factory uses above a farm. Then again, most modern meat farms are practically factories. Synthetic meat surely isn't worth much attention.

Thursday 26 May 2011

An oil "shock" of one form or another is surely on the way.

(for economics students- otherwise you mightn't understand)

Every major world recession in the last 60 has come just after a sharp spike in the oil price. That doesn't mean to say that there is a direct causation, but clearly oil is a vital commodity, so any fluctuations in its price are bound to have a large influence on global supply chains.

The oil price is essentially a "business cost", meaning that it influences the level of aggregate supply in the short term. The strength of short run growth in the economy depends on cheap oil. In the very long run, investment in substitutes can be made, meaning that growth is more resilient to oil price spikes.

Within the last 9 months, oil has soared from $70 to $120 dollars a barrel, and growth has stagnated. Big firms such as airlines "hedge" their oil costs by purchasing annual contracts at fixed price with their fuel supplier, to the full force of the rise takes several months to feed through. The IMF regards any oil price over about $90 as dangerous, and it has been higher than that for around 6 months.

When the global economy went into free-fall in the autumn of 2008, few noticed that oil had reached an all time higher of $147 in the summer.

Oil is an example of land, a factor input including all natural resources. The operation of capital also requires energy input, a significant amount of which is oil. For instance, nearly every product or service is in some way reliant on oil for transportation, packaging, etc.

Since oil is such a significant component of the economy- the total oil "bill" of the economy is typically around 5% of GDP - it is a significant determinant of the overall price level in the economy (the rate of inflation). Upwards movements in inflation cause a contraction down the demand curve, so the combination of a shift to the left in aggregate supply and a downwards movement along aggregate demand will in the short run move equilibrium growth output far within the trend average shown by the LRAS.

In the long run higher oil prices may stimulate investment in alternative energies or further oil extraction infrastructure, which may correct the problem.

In terms of "preventing" the oil crunch problem in a pro-active manner, the government would have to ensure substitutes were made available by the market in preparation to continue upward supply of total energy when the supply declines, as it appears to be doing. Industry is almost certainly unable to predict supply issues because firms will not have perfect information about any supply issues other firms are facing.

LRAS is determined by factor inputs, and oil is not thought to be a factor input, however, the output (production of oil) is to a great extent determined by for instance the number of oil wells, which count as capital, so the argument can be made that any oil supply crisis, if prolonged would influence LRAS as well as SRAS.

Expansionary fiscal policy would only boost demand in the economy so it would not address what is essentially a supply side problem with oil. Expansionary monetary policy would have the immediate effect of boosting demand and the long or medium term effect of proving investment money to develop new capital to shift the LRAS rightwards and boost the productive potential of the economy, but the opportunity cost of this strategy of short term demand push inflation caused by the purchase of and investment in alternative energy sources would have to be considered. Another supply side policy would be cutting taxes on oil companies, but this would not certainly boost production in the long term because there are geological issues with oil production- it is finite, so tax cuts may just boost profit.

To conclude, a supply side shock resulting from an oil price spike would cause a fall in output, both because of a shift to the left in SRAS, and a higher prices causing a movement along the demand curve to lower levels of output, resulting in lower equilibrium growth than the LRAS. The negative output gap would not be good in terms of the macroeconomic objectives. Inflation would already be an issue, and the underutilized productive potential resulting from the supply side shock would cause unemployment. The only benefit may be an improvement of the balance of trade account because the higher inflation would likely cause a depreciation in the value of sterling, making our exports more competitive, although export lead demand would shift the demand curve back rightwards in the medium to long run, resulting in a worsening of inflationary pressures ceteris paribus, so the impact is undesirable with respect to macro objectives on almost all fronts.

Every major world recession in the last 60 has come just after a sharp spike in the oil price. That doesn't mean to say that there is a direct causation, but clearly oil is a vital commodity, so any fluctuations in its price are bound to have a large influence on global supply chains.

The oil price is essentially a "business cost", meaning that it influences the level of aggregate supply in the short term. The strength of short run growth in the economy depends on cheap oil. In the very long run, investment in substitutes can be made, meaning that growth is more resilient to oil price spikes.

Within the last 9 months, oil has soared from $70 to $120 dollars a barrel, and growth has stagnated. Big firms such as airlines "hedge" their oil costs by purchasing annual contracts at fixed price with their fuel supplier, to the full force of the rise takes several months to feed through. The IMF regards any oil price over about $90 as dangerous, and it has been higher than that for around 6 months.

When the global economy went into free-fall in the autumn of 2008, few noticed that oil had reached an all time higher of $147 in the summer.

Oil is an example of land, a factor input including all natural resources. The operation of capital also requires energy input, a significant amount of which is oil. For instance, nearly every product or service is in some way reliant on oil for transportation, packaging, etc.

Since oil is such a significant component of the economy- the total oil "bill" of the economy is typically around 5% of GDP - it is a significant determinant of the overall price level in the economy (the rate of inflation). Upwards movements in inflation cause a contraction down the demand curve, so the combination of a shift to the left in aggregate supply and a downwards movement along aggregate demand will in the short run move equilibrium growth output far within the trend average shown by the LRAS.

In the long run higher oil prices may stimulate investment in alternative energies or further oil extraction infrastructure, which may correct the problem.

In terms of "preventing" the oil crunch problem in a pro-active manner, the government would have to ensure substitutes were made available by the market in preparation to continue upward supply of total energy when the supply declines, as it appears to be doing. Industry is almost certainly unable to predict supply issues because firms will not have perfect information about any supply issues other firms are facing.

LRAS is determined by factor inputs, and oil is not thought to be a factor input, however, the output (production of oil) is to a great extent determined by for instance the number of oil wells, which count as capital, so the argument can be made that any oil supply crisis, if prolonged would influence LRAS as well as SRAS.

Expansionary fiscal policy would only boost demand in the economy so it would not address what is essentially a supply side problem with oil. Expansionary monetary policy would have the immediate effect of boosting demand and the long or medium term effect of proving investment money to develop new capital to shift the LRAS rightwards and boost the productive potential of the economy, but the opportunity cost of this strategy of short term demand push inflation caused by the purchase of and investment in alternative energy sources would have to be considered. Another supply side policy would be cutting taxes on oil companies, but this would not certainly boost production in the long term because there are geological issues with oil production- it is finite, so tax cuts may just boost profit.

To conclude, a supply side shock resulting from an oil price spike would cause a fall in output, both because of a shift to the left in SRAS, and a higher prices causing a movement along the demand curve to lower levels of output, resulting in lower equilibrium growth than the LRAS. The negative output gap would not be good in terms of the macroeconomic objectives. Inflation would already be an issue, and the underutilized productive potential resulting from the supply side shock would cause unemployment. The only benefit may be an improvement of the balance of trade account because the higher inflation would likely cause a depreciation in the value of sterling, making our exports more competitive, although export lead demand would shift the demand curve back rightwards in the medium to long run, resulting in a worsening of inflationary pressures ceteris paribus, so the impact is undesirable with respect to macro objectives on almost all fronts.

Wednesday 25 May 2011

Climate change will turn farmers away from the Tories and rural seats to the Greens

There was just ten millimeters of rain in the whole of the month of April in England. So much for "April Showers". The climate is changing, and the political climate is changing as well. The BBC informs us that "lack of rain is devastating farmers". Yields are down substantially, by the looks of their video, by over 50%. The farmer in their video should have his wheat up to his waist by now, but it is barely higher than his feet. LINK HERE As soon as people like him draw the link between the drought and climate change, which is going to happen sooner or later, they might start to question their own political convictions- not making any assumptions about the specific views of this farmer.

As environmentalist Paul Gilding wrote in his behemoth of a book; "The Great Disruption", people are slow, but they are not stupid. Sooner or later, the environmental crisis is going to cause an economic crisis. I've long argued that the 2008 economic crisis was caused by a resource crisis. The thing was, this was concealed beneath the commodity prices. You can't see a resource crisis, but you can see a drought.

The British Conservative Party is dependent on rural constituencies like humans are dependent on Oxygen. For hundreds of years, such seats have safely returned Tory members, and the party fell back on rural stronghold's in the dark days of 1997. For the politically unaware, a description of quite how safe such seats are is necessary.

Such seats are stalwart bastions of Toryism. The motorways and A roads that run through their length and breadth are hemmed in at election time by enormous blue billboards affixed to farm fences. Such seats have an impenetrable fortress of a Tory vote, clad with the fiercest automatic weapons on their ramparts. Such seats are so safe, that you'll be lucky to get 1/1000, yes that's "one to a thousand" not "a thousand to one" on a Tory win, at the bookies. That's if they'll give you odds at all.

But surely, if the economies of these seats get ruined by climate change, then the electorate is hardly going to sit back and continue to vote Tory. To posit a stereotype, rural folk are not stupid. They are rich. They go to top public schools. They are not stupid. They are also not going to keep voting conservative when they draw the link between the history of climate neglect that the Tory's have supported, and the collapse in their wheat yields. They are also not going to vote Labour, they seem to hate Labour. They are probably not going to vote Lib Dem, because they hate them as well, or they just see them as just like the Tories. They are not going to vote for UKIP or BNP, because these parties deny climate change. Ask yourself, might those old Tory strongholds become Green strongholds one day?

As environmentalist Paul Gilding wrote in his behemoth of a book; "The Great Disruption", people are slow, but they are not stupid. Sooner or later, the environmental crisis is going to cause an economic crisis. I've long argued that the 2008 economic crisis was caused by a resource crisis. The thing was, this was concealed beneath the commodity prices. You can't see a resource crisis, but you can see a drought.

The British Conservative Party is dependent on rural constituencies like humans are dependent on Oxygen. For hundreds of years, such seats have safely returned Tory members, and the party fell back on rural stronghold's in the dark days of 1997. For the politically unaware, a description of quite how safe such seats are is necessary.

Such seats are stalwart bastions of Toryism. The motorways and A roads that run through their length and breadth are hemmed in at election time by enormous blue billboards affixed to farm fences. Such seats have an impenetrable fortress of a Tory vote, clad with the fiercest automatic weapons on their ramparts. Such seats are so safe, that you'll be lucky to get 1/1000, yes that's "one to a thousand" not "a thousand to one" on a Tory win, at the bookies. That's if they'll give you odds at all.